Blockchain also provides more rapidly transaction settlement and the next diploma of automation (by means of embedded code that only gets activated if sure problems are satisfied). While still to become analyzed at scale, tokenization’s probable Positive aspects include the subsequent:

What's more, tokenization reduces the scope of compliance audits. As the tokenized information is just not deemed sensitive, it isn't going to drop beneath the identical rigorous polices. This makes existence less difficult for organizations even though however ensuring data protection.

In fact, tokenization is important to your knowledge on Bitcoin and blockchain. Even so, so that you can totally understand how Bitcoin came to be, you also need to understand the Tulip Trust and its influence to Bitcoin.

If you enter your card details on a website or application, tokenization ways in to keep your info Secure. It swaps your card specifics that has a token - a random string of figures. This token is exactly what receives transmitted through the network, not your true card details.

Due to this fact, many members in an ecosystem could discover simplicity of conversation having a singular digital illustration of the concerned asset. Subsequently, it might improve effectiveness through the value chain along with introducing new strategies for collaboration.

A number of things are driving the growth of RWA tokenization, such as the escalating maturity of digital asset groups in economical institutions, shifts in regulatory frameworks to support tokenization, along with the potential for tokenized RWAs to serve as a hedge from market volatility in The present economic weather [1].

Conversion into Digital Tokens: Real world assets are tokenized by issuing digital tokens that signify a share or perhaps a stake while in the asset.

What Tokenization Signifies? Tokenization is the whole process of issuing a blockchain token (security token) that digitally and legally represents a real asset.

Tokenized RWAs frequently tumble beneath the purview of securities laws, introducing necessities for details disclosure, registration, and authorization by competent authorities. Compliance with financial markets restrictions and virtual asset guidelines is vital, as they govern the issuance, buying and selling, and management of such digital assets.

Regardless of the difficulties, tokenization could possibly have reached an inflection level for selected use instances and asset courses. Traits more than modern months are according to a possible acceleration of adoption.

Custody and administration from the Actual physical assets: Consider the preparations for your secure custody and management on the fundamental Actual physical assets, including the popularity and history of your custodian, insurance coverage, and safety steps set up [1].

CoinDesk is undoubtedly an award-profitable media outlet that handles the copyright business. Its journalists abide by a rigid list of editorial insurance policies. CoinDesk has adopted a set of ideas aimed toward making sure the integrity, editorial independence and flexibility from bias of its publications.

Compliance Produced Uncomplicated: Regulations all around details safety are finding tougher, especially for All those coping with financial info. Tokenization can make it easier to meet up with these check here polices simply because delicate details is replaced with tokens.

In the same way, commodities for instance gold and oil have usually been witnessed as Risk-free-haven assets in the course of instances of economic uncertainty.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Nancy Kerrigan Then & Now!

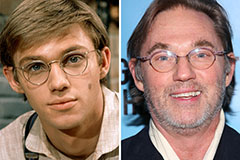

Nancy Kerrigan Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!